By Ajita Dash & Kavya Thapliyal

A Private Limited Company is a business entity established in accordance with the Companies Act, 2013 that provides basic functions such as ownership transfer via shares, limited liability to shareholders, and perpetual existence. The Companies Act, 2013 has provided a framework for the incorporation of Private Limited Companies, provided that certain necessary requirements are met.

Governing Law & Requirements

Establishing a Private Limited Company (Pvt. Ltd. Company) involves navigating legal frameworks and fulfilling specific criteria laid down by the governing law. Hereinafter, we shall outline the key aspects of the governing law and the requirements for registering a Pvt. Ltd. Company. In India, the Companies Act, 2013 largely governs the establishment and functioning of Pvt. Ltd. Companies. The legal foundation for the formation, administration, and dissolution of businesses, including Pvt. Ltd. Companies, is provided by the Act itself.

Certain requirements have been provided under the Act for the registration of a Private Limited Company:

- Shareholders – A Private Limited Company’s shareholders are its co-owners. The ratio of their shares determines the percentage of ownership. A private limited company must have a minimum of two (2) and a maximum of two hundred (200) shareholders. The initial shareholders who have handled the incorporation procedures of a company are collectively known as its Promoters.

- Directors – Since not every decision can be taken with the consensus of all the shareholders, Directors are appointed by them as representatives. Directors of a company are responsible for carrying out the managerial and day to day operations of a company. They are also entrusted with ensuring that all the compliances of the Company are being taken care of. A minimum of two (2) directors must be appointed during the registration of the Company and the number of directors may extend up to fifteen (15) as per the Companies Act. However, the shareholders can raise the number of directors beyond fifteen (15), if need be, by passing a special resolution to this effect in the General Meeting.

- An Indian Resident Director – The Companies Act, 2013 puts a restriction on the resident status of at least one director in a Private Limited Company. It prescribes that at least one of the directors appointed in a Private Limited Company must be an Indian Resident. As per the Section 149(3) of the Companies Act, 2013, every Private Limited Company must have at least one director who has stayed in India for a minimum of one hundred and eighty-two (182) days in the previous Calendar year. Such a Director shall be called an Indian Resident Director. The prescribed number of days need not be continuous and can be calculated as the overall days of stay.

- Valid Company Name – One of the crucial requirements for company registration in India is a name approved by the Registrar of Companies (ROC). It must not be similar, or identical to the name of an existing company or infringe upon an existing or applied trademark. Also, it must not contain words prohibited for use under the Names & Emblems Act, 1950. After an appropriate name is chosen, it needs to be proposed to the ROC for approval. The ROC, after examining the application, may accept, send for resubmission or reject the name. If the name is accepted, it shall be reserved as the name of the company for a period of twenty (20) days, within which the application for incorporation of the company must be submitted before the ROC. On the other hand, if it gets rejected a fresh application for name approval will have to be filed.

- Registered Office – Companies need to maintain a Registered Office at all times as per Section 12 of the Companies Act, 2013. A Registered Office is the office address with which a company gets incorporated. This address is maintained by the ROC in their public records and is accessed by all government authorities and other private stakeholders for official communication and correspondence.

- Capital – Capital is the fund invested by the shareholders in exchange for a percentage of ownership in the company with the help of shares. There is no specified minimum amount requirement of capital in a company as the shareholders are free to contribute as per their will. A capital may be of many kinds such as Authorized Capital, Issued Capital, Paid-up Capital, Share Premium, etc.

- Digital Signature Certificates (DSCs) – As of today, the application process for the incorporation of a company is completely digital. In order to incorporate a company, a form is required to be filled and submitted online along with the prescribed set of documents authenticated and attested using the Class 3 Digital Signature Certificate of the authorized director or signatory.

Incorporation Procedure

Choosing and reserving a distinctive company name is usually the first step in the registration procedure for a Private Limited Company (Pvt. Ltd. Company). Following the name approval, the company’s goals and regulations are outlined in the Memorandum and Articles of Association, which are then produced and submitted to the Registrar of Companies. In addition, the required paperwork is filed, including forms of consent from the directors and shareholders as well as identification and address verification. After the necessary costs are paid and the paperwork is verified, the Registrar grants a Certificate of Incorporation, which formally acknowledges the company’s existence.

- Step 1: Apply for Digital Signature Certificate (DSC)

- Step 2: Apply for the Director Identification Number (DIN)

- Step 3: Apply for the business name availability

- Step 4: File the e-Memorandum of Association (eMoA) and e-Articles of Association (e-AOA)

- Step 5: Get a Certificate of Incorporation from the Registrars of Companies

Post-Registration Compliances

Application For Permanent Account Number (PAN)

Each company is required to acquire a Permanent Account Number (PAN) from the Income Tax Department, Government of India. PAN serves as a unique identification number for every taxpayer as per the provisions of the Income Tax Act, 1961. To obtain a PAN, the company must submit an application along with a copy of its Certificate of Incorporation.

Application For Tax Deduction and Collection Account Number (TAN)

Any Private Limited Company intending to employ individuals in the foreseeable future must secure a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department, Government of India. Specific types of payments necessitate Tax Deduction at Source (TDS), and the deducted tax must be forwarded to the government. Acquiring a Tax Deduction and Collection Account Number (TAN) is necessary to facilitate the remittance of TDS.

Opening of a Company Bank Account

Following the registration of the Company, it is vital to establish a Current Account under the Company’s name with any bank operating in India. All transactions associated with the Company must exclusively be conducted through the Company Bank Account.

Appointment of Auditor (ADT-1)

Within thirty (30) days of incorporation, the company must appoint an auditor by filing the form ADT-1. The first auditor of the company will hold office until the conclusion of the first AGM.

Issue of Share Certificates (SH-1)

Within two (2) months of its incorporation, a private limited company must deliver Share Certificates (SH-1) to the subscribers listed in its Memorandum of Association. According to the terms of the Indian Stamp Act, 1899, the stamp tax on the share certificates must be paid within thirty (30) days after the date of issuance.

Filing the Declaration for Commencement of Business (INC-20A) Form

A company cannot initiate operations unless a Declaration for Commencement of Business (INC-20A) is filed within one hundred and eighty (180) days following the firm’s date of incorporation. The firm must open a bank account in order to comply with this requirement, and the initial subscribers must deposit their subscription funds in line with the shareholding ratio specified in the company’s Memorandum of Association.

Annual General Meeting (AGM)

Every company must hold an Annual General Meeting (AGM) within six (6) months of the end of each fiscal year, regardless of paid capital and turnover and subsequently hold an AGM once every year thereon.

Filing the MSME-1 Form

All companies receiving goods/services from any MSME Companies, must file the form MSME-1 within thirty (30) days from the availability of the form on the MCA Portal. Furthermore, the form MSME-1 must be filed within thirty (45) days from the end of each half-year.

Goods and Services Tax (GST) Registration

Businesses with an annual turnover exceeding Rs. 40 lakhs (or Rs. 20 lakhs for service providers) are mandated to register for GST under the Goods and Services Tax (GST) Act and Rules. However, obtaining GST registration immediately after the incorporation of the company is not obligatory. The company can acquire this registration as and when necessary, based on its turnover reaching the prescribed threshold.

Employees’ State Insurance Corporation (ESIC) and Employees’ Provident Fund Organization (EPFO) Registration

Newly incorporated companies are exempt from complying with the EPFO (Employee Provident Fund Organization) or ESIC (Employees’ State Insurance Corporation) provisions until they reach a threshold of 20 employees for PF (Provident Fund) and 10 employees for ESIC.

Professional Tax Registration

Depending on the state in which the company operates, it may need to register for professional tax and obtain a professional tax registration certificate.

Application for Trade License

The company may need to obtain a trade license from the local municipal corporation or authority to conduct its business activities.

Intellectual Property Registrations

Every company wants to protect their brand identity since their intellectual properties as their goodwill. Thus, once the registration and initial compliances of a company has been completed, a company might consider filing a Trademark for the name of their business or products.

In case of failure of complying with the mandatory post-registration compliances, the company shall be penalized as per the applicable provisions of the Act.

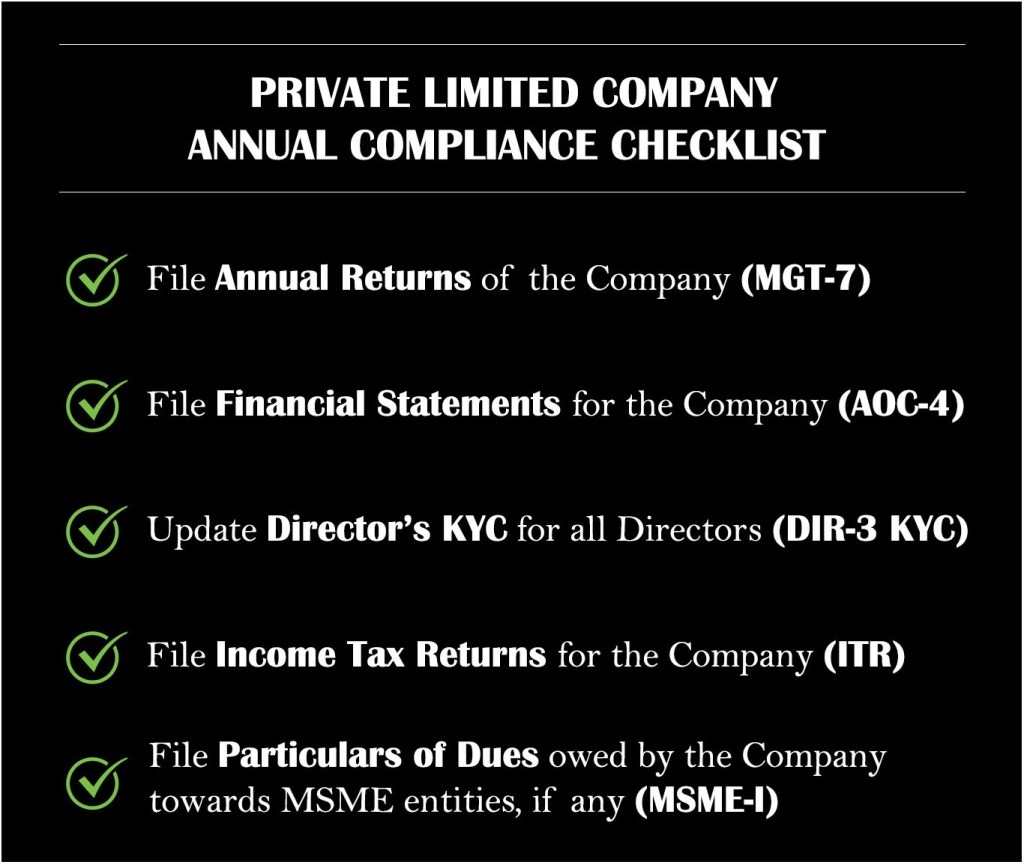

Annual Compliances

Every Private Limited Company (Pvt. Ltd.) must fulfil certain annual compliances which typically include several statutory requirements that must be fulfilled on an annual basis to maintain compliance with the regulations. Here’s a general overview of the annual compliances for Private Limited Companies in India:

Annual Returns (MGT-7)

The Annual Returns of a Company must be filed using the MGT-7 form within 60 days from the date of the last Annual General Meeting.

Financial Statements (AOC-4)

The Financial Statements of a Company must be filed using the AOC-4 form within thirty (30) days from the date of the last Annual General Meeting.

Director KYC (DIR-3 KYC)

For every Director who has been allotted a DIN, the DIR-3 KYC form must be filed on or before 30th September of each year.

Income Tax Returns (ITR)

The income tax return for the company should be filed with the Income Tax Department on or before the due date specified under the Income Tax Act, which is generally July 31 of the assessment year. However, it’s advisable to check for any changes in the due date as per the latest notifications.

Tax Audit

If the turnover of the company exceeds the prescribed threshold limit under the Income Tax Act, a tax audit by a chartered accountant is required. The due date for tax audit is generally September 30 of the assessment year.

Comparison between Limited Liability Partnerships (LLP) and Private Limited Companies

Like Pvt. Ltd. Companies, an LLP is a business form that provides its participants with limited liability protection, perpetual succession and a common seal. LLPs, unlike Pvt. Ltd. Companies, have less stringent compliance standards and a more adaptable management structure. Since Pvt. Ltd. Companies and Limited Liability Partnerships provide similar limited liability protection and operational flexibility, people frequently find it difficult to decide between them. When choosing a structure, entrepreneurs must carefully consider the benefits and drawbacks of each option, taking into account variables including management preferences, finance needs, and long-term business objectives. The table below lists out the nuances of each

| Particulars | Limited Liability Partnership | Private Limited Company |

| Registration | LLPs must be registered under the Limited Liability Partnership Act, 2008. | Private Limited Companies must be registered under the Companies Act, 2013. |

| Name | The name of a Limited Liability Partnership must be followed by the term “LLP” at the end. | The name of a Private Limited Company must be followed by the terms “Private Limited” at the end. |

| Legal Status | An LLP is a separate legal entity under the LLP Act, 2008. | A Private Limited Company is a separate legal entity under the Companies Act, 2013. |

| Ownership and Management | Partners of LLPs have ownership as well as managerial powers. | Management is different from ownership in Private Limited Companies. Shareholders do not have managerial powers in the Company. |

| Governing Documents | The governing document in a LLP is the LLP agreement. | The governing documents in a Private Limited Company are the Memorandum of Association (MOA) and Article of Association (AOA). |

| Identification Numbers | The Designated Partners must have a Designated Partner Identification Number. | The Directors must have the Director Identification Number. |

| Directors, Shareholders and Partners | There must be a minimum number of 2 Designated Partners in an LLP. There is not limit on the maximum number of Partners. | A minimum of 2 and a maximum of 200 shareholders are permitted in a Private Limited Company. Moreover, the number of Directors must be between 2 to 15 in a Company. |

| Funding and Investments | LLPs cannot raise capital with the help of Venture Capitalists or Angel Investors since they would need to be Partners in the firm in order to invest. They can however acquire funding through banks or various Government funding schemes. | Private Limited Companies can raise capital and get funding through VCs and Angel Investors by making them shareholders in the Company. They may also apply for Government Funding Schemes. |

| Foreign Direct Investments | Foreigners may invest in an LLP only with prior approval of the Reserve Bank of India (RBI) and the Foreign Investment Promotion Board (FIPB). | Foreigners may invest in Private Limited Companies through the automatic approval route in several sectors. |

| Taxation | An LLP is taxed at the rate of 30% up to an annual income of 1 crore and an additional 12% surcharge if the total income exceeds 1 crore. | Private Limited Companies are taxed at 25% if turnover is up to 400 crores. Beyond that a rate of 30% is levied. |

| Annual Statutory Meetings | LLPs are not required to conduct Annual Statutory Meetings. | Private Limited Companies are required to conduct Statutory Board Meetings periodically. |

| Legal Compliances | Lesser legal compliances are required. | The legal compliances in a Private Limited Company are much higher. |

| Dissolution | An LLP can be dissolved voluntarily or by an order from the NCLT. Winding up an LLP is much more convenient than that of a Private Limited Company. | Winding up of a Private Limited Company is much more procedural than that of an LLP. |

| Who is it suitable for? | Business owners who want to enjoy the perks of a company without having to go through lengthy and procedural legal compliances. | Business owners who plan to scale up and attract investments from VCs and Angel investors in order to grow their business multi-fold. |

Incorporate your Company today!

A strong framework for enterprises can be obtained by establishing a Private Limited Company (Pvt. Ltd. Company) in accordance with the Companies Act, 2013, which grants the shareholders limited liability, permanent existence, and unambiguous ownership transfer procedures. Knowing the minimum prerequisites for registering a Pvt. Ltd. company is crucial for a smooth incorporation procedure. It can be difficult to distinguish LLPs from Pvt. Ltd. Companies because of their similar limited liability protection and flexible operating environments. To choose between these two business forms, entrepreneurs must carefully consider their long-term business objectives, finance requirements, and management preferences. Ultimately, following legal guidelines and compliance standards guarantees the legitimate formation and continuous operation of Private Limited Companies in the ever-changing business environment.

The team of experts at Advoke Law actively assist the proprietors of new businesses decide upon the most-suitable business structure and get registered as Sole Proprietorships, Partnership Firms, Limited Liability Partnerships, Private Limited Companies and One-person Companies. Feel free to contact us to schedule a free consultation today!